Post highlights

- The accounting equation

- The expanded accounting equation

- Recording transactions utilizing the accounting equation

- Tutorial Video

PRACTICING ACCOUNTING TRANSACTIONS

COLLEGE ACCOUNTING: THE ACCOUNTING EQUATION AND TRANSACTIONS

This helpful tutorial video will go through several different transactions that you will see in your earlier chapters for college accounting. In the first chapter of college accounting, you will learn the accounting equation and the expanded accounting equation. You will then practice using these equations with accounting transactions.

A business is considered a separate business entity. Simply put, business finances are kept separate from personal finances. Even with a sole proprietorship (one owner), this practice must be followed.

All transactions that occur in business use the accounting equation. The accounting equation is the basic tool of accounting. It helps with measuring the resources of a business and the claims to those resources.

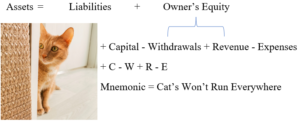

The accounting equation:

Assets = Liabilities + Owner’s Equity

The accounting equation is expanded to show the components of Equity:

In this tutorial video, we will practice using the expanded accounting equation to record accounting transactions.

Also, it is important to note that we are learning transactions for a sole proprietorship in the tutorial video. The concept is the same for financial accounting where you are learning accounting for a corporation.

To very briefly discuss, some terms are different in college accounting versus financial accounting. In college accounting, the term for when an owner takes funds out of the business for personal use is Withdrawals. In financial accounting, the term for when earnings are distributed to shareholders is Dividends. I briefly discuss this in the video.

After you have mastered understanding transactions, you are ready to start building onto the concept with debits and credits.