Highlights for Completing the Accounting Cycle

- Recording Adjusting Journal Entries – Video

- Understanding the Closing Process

- Three Tutorial Videos

- Worksheet for Following Along

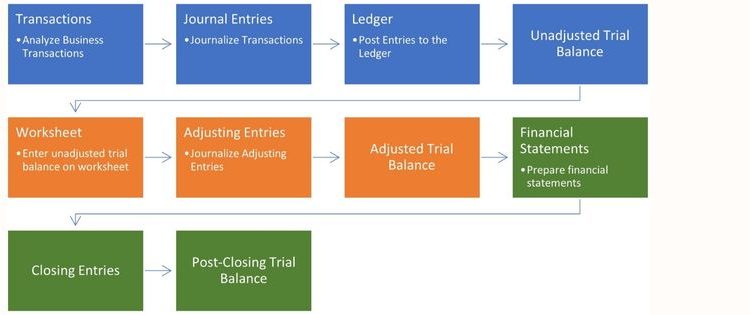

We are now at the end of the accounting cycle. Our final steps for completing the accounting cycle are to journalize and posting closing entries. In order to make a recording of the next period’s transactions easier we will “close out” our temporary accounts. The main purpose of the closing entry is to reset the temporary account balances to zero on the general ledger. To understand better, let’s define permanent and temporary accounts.

Real or permanent accounts are assets, liabilities, and capital. Their balances are carried over from one accounting period to another. They track activities that extend beyond the current accounting period and are located on the balance sheet. The permanent accounts give investors, creditors, and managers an idea of a company’s value.

Revenues, expenses, and withdrawals are called nominal or temporary accounts because their balances will not carry over from one accounting period to the next. Instead, we will zero out these temporary accounts’ balances. This process allows us to obtain new data for revenue, expenses, and withdrawals for each accounting period. This is helpful for external parties, like creditors or investors, and internal, planning and forecasting purposes. The process of closing summarizes the effects of revenue, expenses, and withdrawals on capital.

There are four steps for the closing process:

- Step 1 – Zero out Revenue Balance

- Step 2 – Zero out Expenses Balance

- Step 3 – Zero out Income Summary Balance

- Step 4 – Zero out Withdrawals Balance

* There is a brief tutorial video (part 1) on how to record adjusting journal entries. This topic is included in this section as the textbook for college accounting starts the chapter on how to record adjusting journal entries. So, to keep in line with the textbook, I have included that tutorial as well. Please see my previous blog post for more on adjusting journal entries.