Introduction

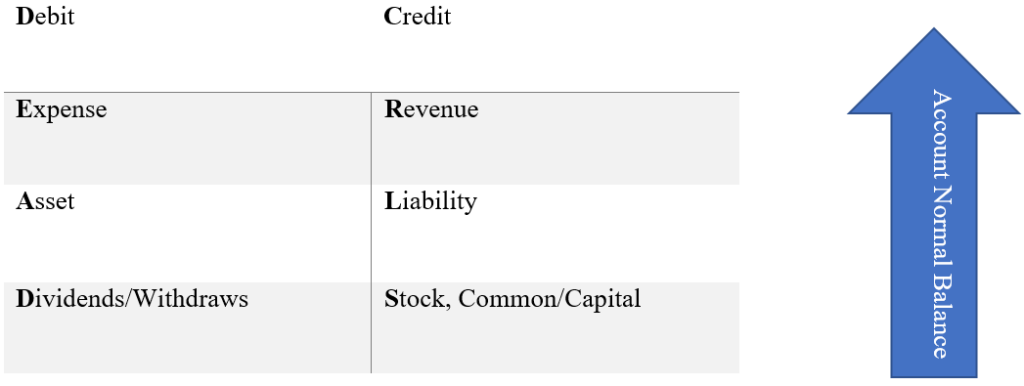

My favorite mnemonic for learning debits and credits is DEAD CRLS. It seems to work the best for students, but there are many different mnemonics to use.

The use of debits and credits for accounting can be traced back to our “Father of Accounting,” Luca Pacioli. Pacioli was the first to record detailed materials on the double-entry system of accounting. He is known for saying, “A person should not go to sleep at night until the debits equal the credits” (Pacioli, 2009). This quote is super important to remember as we dive into DEAD CRLS.

You should have an understanding already of the accounting equation, Assets = Liabilities + Equity, and the dual nature of accounting.

College Accounting vs. Financial Accounting

It is also important to take note of the course we are taking as there may be differences in terms. If you are taking College Accounting, you will be learning accounting for a sole proprietorship. If you are taking Financial Accounting, you will be learning accounting for a corporation. There are a few differences in the terms used in these two courses.

There is a difference between the Equity term used for a sole proprietorship and for a corporation, but it is essentially the same thing. Briefly put, there is Shareholders’ equity and Owner’s equity. Shareholders’ equity (also known as stockholders’ equity) is the term used for corporations (Financial Accounting) and Owner’s equity is the term used for privately owned sole proprietorships (College Accounting).

Also, there is a difference between the terms for money taken out of the business. Briefly put, the term Withdrawals will be used for sole proprietorships (College Accounting) and the term Dividends will be used for corporations (Financial Accounting).

DEAD CRLS

Every transaction can be described in debit and credit form and for every transaction, debits must equal credits. My favorite way to start with memorizing what accounts are increased with either a debit or credit is with the use of the mnemonic DEAD CRLS. You are memorizing. Many students try to form a logical way of understanding the increase and decrease in accounts, but they are almost always flawed. Remember, accounting is a new language. You cannot use our English language definitions for debits and credits. Debits and Credits have different meanings in accounting.

An account’s normal balanced side is the side it increases on (either a Debit or Credit side). So, hopefully, when we look at a financial statement, we will see that account with its normal side balance. If we don’t, we should question if it is correct.

Since I am a fan of weightlifting, I remember DEAD CRLS by thinking of DEADlifts and CuRLS, but you can also think of the humidity in Florida, and immediately after going outside your just nicely curled hair becomes “dead curls.”

For this mnemonic, we will place DEAD CRLS in a large T-account. This T-account will tell us what the normal balance is for each account. This normal balance is the side this particular account will increase on. Debit increases in Expenses, Assets, and Dividends. Credit increases in Revenues, Liabilities, and Stock, Common/Capital. When an account decreases, it will be on the opposite side.

Example 1 using DEAD CRLS:

Company A received $15,000 cash for services. The company’s cash account is increasing by $15,000 and the Revenue account is also increasing by $15,000. Looking at DEAD CRLS, we can see that Cash is an Asset and so the increase will be on the Debit side. We can also see that Revenue is increasing and so it will be on the Credit side.

The journal entry will look like:

Cash $15,000

Service Revenue $15,000

We can see that there is one debit for $15,000 and one credit for $15,000. Debits = Credits. We are in balance! And here we go with Pcioli’s quote that “A person should not go to sleep at night until the debits equal the credits” (Pacioli, 2009).

References:

Luca Pacioli. (n.d.) Farlex Financial Dictionary. (2009). Retrieved December 23 2022 from https://financial-dictionary.thefreedictionary.com/Luca+Pacioli